There are a great number of rather scary sounding studies and reports that talk about the cost of IT downtime being in the millions, billions, and trillions of dollars per year by taking aggregate figures across all US businesses. They are largely funded by the IT industry to scare people into investing in more technology and services. Many of these investments are wise and sound and others are not. These types of studies don’t help you make an informed choice. If your small business had trillions of dollars to lose, you’d be long retired drinking margaritas on a private island. How do you make an informed and financially sound decision?

The best study we have found on the impact of small business outages can be found here.

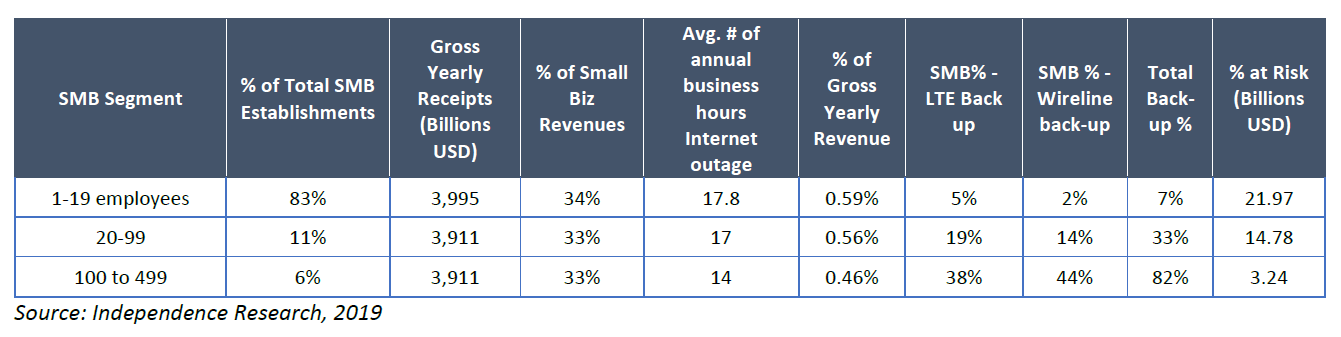

It has those same broad statistics across all business, but it also drills down to the individual business level to provide some meaningful data. The average downtime for a typical small business Internet connection is 17.8 hours per year. Across all businesses this averages out to $4500 per year. Where does your business fall?

There are two main ways to estimate this. One is by total yearly revenue and the other is by total cost of labor. Estimating both is helpful for creating a more accurate picture for your personal circumstances.

Annual Revenue

There are 52 weeks in year, 5 workdays per week for a total of 260 workdays per year. We lose around 10 days a year for holidays leaving us with 250 workdays. At 8 hours per day that comes to 2000 workhours per year. That is $50 an hour per $100,000 in revenue. For 17.8 hours of downtime that is $890 per year per $100,000 of revenue. Calculating losses for both gross and net revenue helps create a better picture.

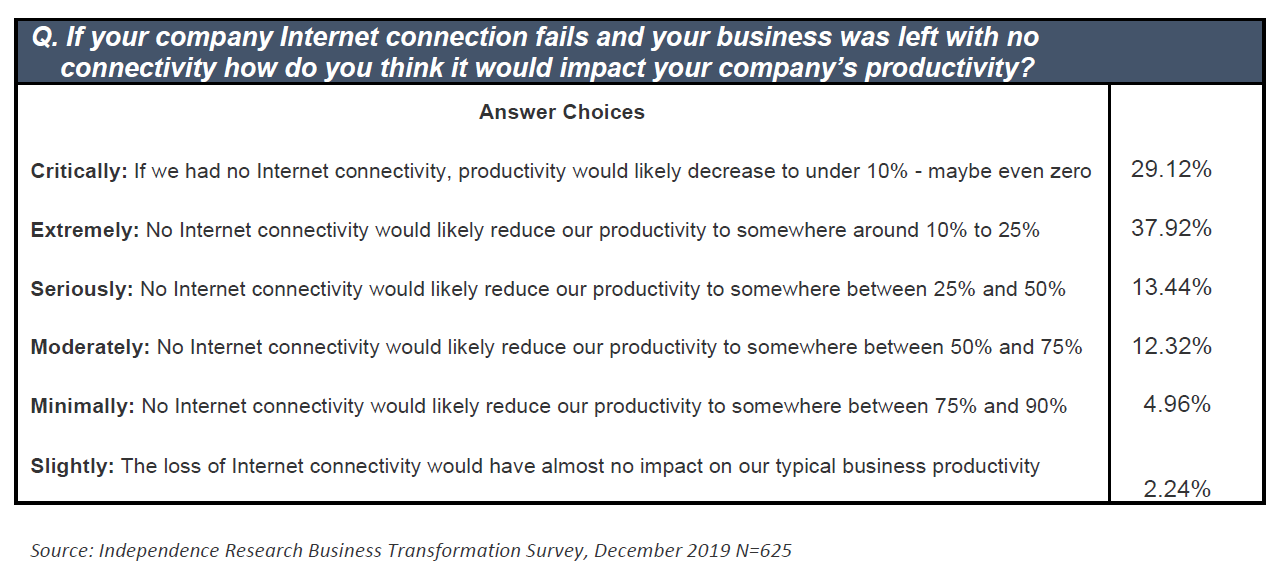

Despite the over two thirds of survey respondents describing an internet outage as “Critical” or “Extreme” equating to between 75% and 100% productivity loss, the vast majority of SMBs do not have internet back-up solutions in place

Cost of Labor

The simplest estimating method is calculating total hourly wages and multiplying them by hours of downtime. A more accurate estimate is taking the total cost of ownership. You are still paying for any benefits, payroll taxes, 401K contributions, etc. during hours of downtime. If your business would need to pay overtime to make up for the lost productivity hours, that should be factored in as well.

There are also other factors to consider that are specific to each business. Not all business days and hours are equal. A CPA firm will be far more heavily impacted by an outage on April 15th when taxes are due than they would be on October 15th. A Deli or Pizzeria has peak food delivery hours where the majority of business is done. Whether a business deals more heavily with relationship based recurring customer transactions or new customers matters. How critical response time is to earning or keeping a customer’s business matters.

Many of these types of factors are hard to narrow down to a simple fixed number. They are specific to each individual business and best understood and weighed by the business owner. For a sole proprietor, whose primary customer interaction is his cell phone, there is a much lower impact from outages. For an IT company who is promising to keep other businesses’ networks up and running, even a small outage can have catastrophic effects upon a company’s reputation.

What would your cost of downtime be? Is it worth risk?